Pakistan Kazakhstan Trade: A Gateway to Regional Growth

Pakistan and Kazakhstan, though separated by a few thousand kilometers, are deeply connected through history, culture, and geography. With Kazakhstan as the largest landlocked country in Central Asia and Pakistan serving as a gateway to the Arabian Sea, both nations hold strategic importance in shaping regional trade.

Key connectivity projects like the QTTA transit trade, Gwadar Port connectivity, and the China–Pakistan Economic Corridor (CPEC) have positioned Pakistan as a natural partner for Kazakhstan to access global markets. Strengthening Pakistan–Kazakhstan trade ties is not just about bilateral gains—it is about building a stronger Pakistan–Central Asia trade corridor for the future.

Historical Background

Early Diplomatic Ties (1991–2000)

- Pakistan recognized Kazakhstan immediately after its independence in 1991.

- Diplomatic relations were formalized in 1992, laying the foundation for trade and cultural cooperation.

Slow Growth in Trade (2000–2015)

- Despite strong political goodwill, trade volume remained negligible.

- Limited logistics routes and lack of direct connectivity hindered progress.

Turning Point: QTTA & Silk Road Corridors (2016–2023)

- With the revival of the Quadrilateral Traffic in Transit Agreement (QTTA), Pakistan dispatched its first shipment to Kazakhstan in 2023 via the Silk Road Dry Port.

- The development of Gwadar Port and CPEC further accelerated interest in closer ties.

Current Trade Statistics

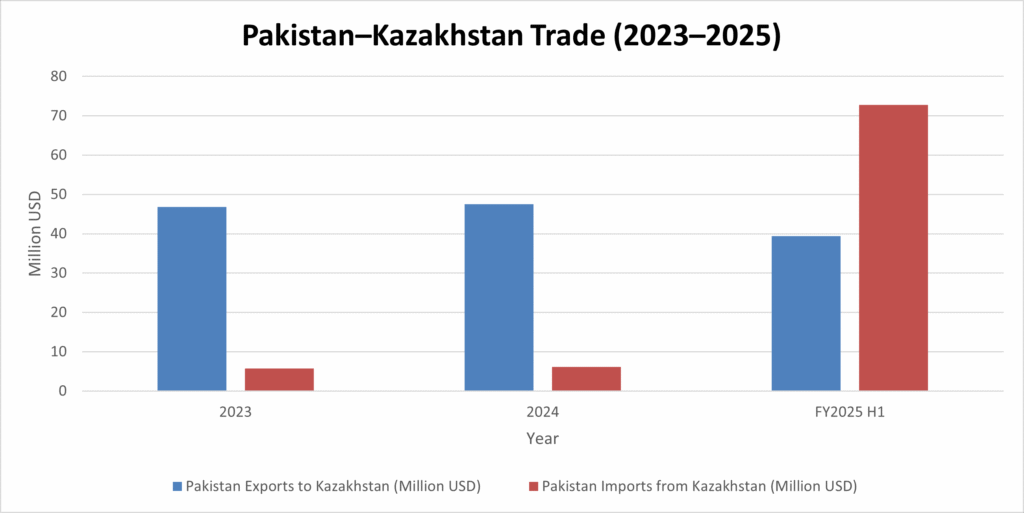

| Year | Total Trade Volume | Pakistan → Kazakhstan (Exports) | Kazakhstan → Pakistan (Imports) |

| 2023 | $52.5 million | $46.8 million | $5.7 million |

| 2024 | ~$53.6 million | Majority share in exports | Limited imports |

| FY2025 (H1) | $112.19 million | $39.43 million (–30.3%) | $72.76 million (sharp increase) |

Key Insights:

- Pakistan’s exports declined by ~30% in the first half of FY2025.

- Kazakhstan’s exports to Pakistan surged due to increased demand for energy, copper, and agricultural products.

- Both countries are targeting $1 billion bilateral trade in the near future.

Key Sectors of Cooperation

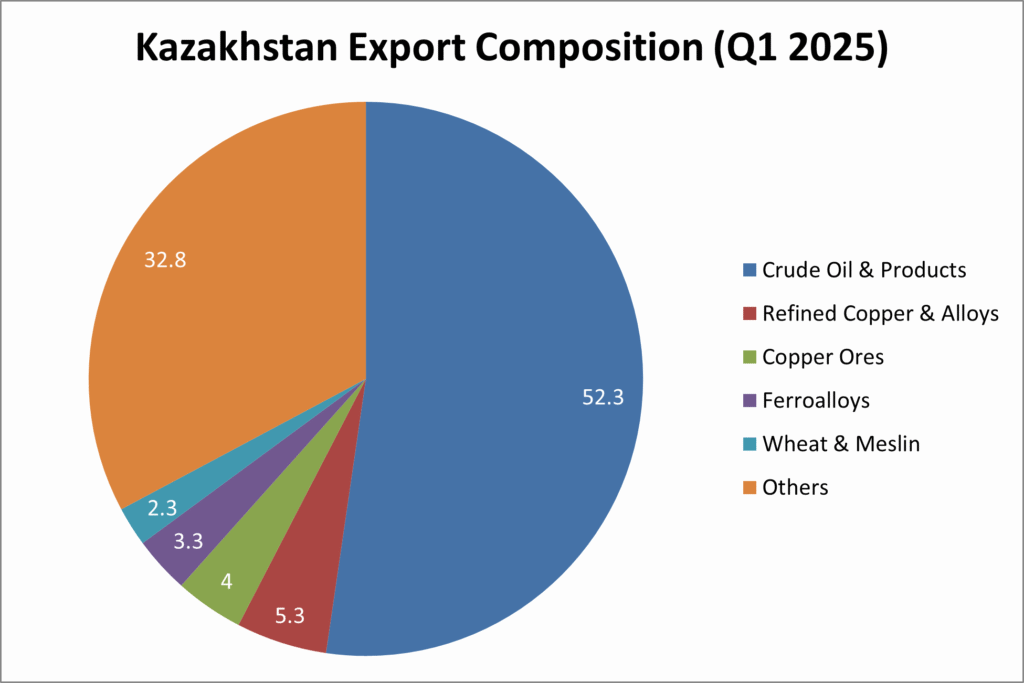

Energy & Minerals: Kazakhstan has huge reserves of crude oil, natural gas, uranium, and copper, which can meet Pakistan’s growing industrial and energy demands. This cooperation can reduce Pakistan’s reliance on expensive imports from distant markets.

Agriculture & Food: Pakistan exports cereals, fruits, vegetables, and oil seeds to Kazakhstan, while Kazakhstan supplies wheat and meslin. This exchange ensures food security and strengthens agro-based trade between both nations.

Textiles & Leather: Pakistan’s high-quality textiles, garments, and leather goods are well-suited for the Kazakh market, giving Pakistan a competitive edge in Central Asia’s fashion and consumer sector.

Pharmaceuticals & Medical Goods: Pakistani pharmaceutical companies already export medicines and medical instruments to Central Asia, including Kazakhstan. Expanding this trade can help Kazakhstan access affordable healthcare products.

IT & Services: Pakistan’s rapidly growing IT sector can provide Kazakhstan with software development, fintech solutions, and e-commerce services, opening new avenues in the digital economy.

Logistics & Transit: Through QTTA and CPEC routes, logistics and trade connectivity between Pakistan and Kazakhstan are improving. This positions Pakistan as a strategic transit hub for Central Asian trade.

Defense & Security: Beyond trade, Pakistan and Kazakhstan collaborate in defense dialogues, training, and security cooperation, which further strengthens their bilateral partnership.

QTTA & CPEC Connectivity

QTTA – Quadrilateral Traffic in Transit Agreement

- Includes Pakistan, China, Kyrgyzstan, and Kazakhstan.

- Activated in June 2023, enabling Pakistan’s first shipment to Kazakhstan through Sost Dry Port.

- Reduces dependency on longer trade routes.

Gwadar Port Connectivity

- Gwadar offers Kazakhstan a direct maritime route to the Arabian Sea.

- Significantly cuts down transport cost and time compared to northern routes.

Synergy with CPEC & Ashgabat Agreement

- CPEC’s road and rail infrastructure connects seamlessly with QTTA.

- The Ashgabat Agreement further strengthens multimodal transport from Central Asia to Pakistan and the Persian Gulf.

Challenges & Barriers

- Logistics & Infrastructure: Seasonal routes, poor road conditions, and limited rail connectivity.

- Tariff & Non-Tariff Barriers: Complicated customs procedures and lack of standards harmonization.

- Banking & Finance: Limited banking channels between the two countries make payments difficult.

- Visa & Travel Restrictions: Business visas are cumbersome, discouraging frequent trade visits.

- Political & Regional Instability: External pressures and regional conflicts often disrupt trade flows.

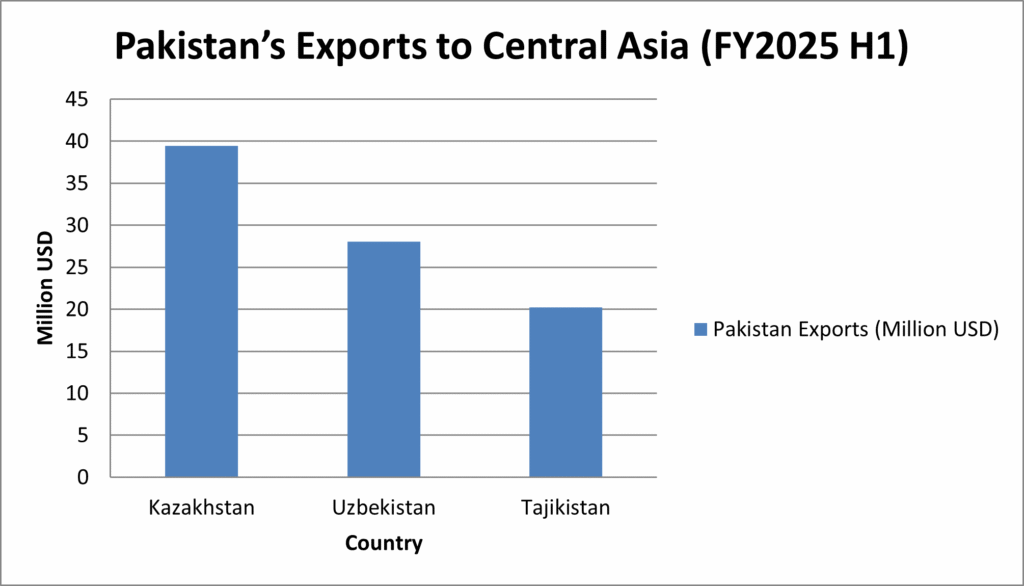

Comparisons – Pakistan’s Trade with Central Asia

- Pakistan’s exports to Kazakhstan in FY2025 (H1) = $39.43M

- Exports to Uzbekistan = $28.04M

- Exports to Tajikistan = $20.24M (notable growth of 60%)

- Overall trade with Central Asia = ~$400–500M annually

Key Insight: Kazakhstan remains Pakistan’s largest Central Asian trading partner, despite the recent dip in exports.

Future Opportunities & Conclusion

Opportunities:

Pakistan and Kazakhstan have immense untapped potential to expand their bilateral trade and economic cooperation. Key opportunities include:

- Boosting high-value exports: Pakistan can increase its exports of textiles, pharmaceuticals, IT services, and leather goods to meet Kazakhstan’s growing demand.

- Promoting joint ventures: Both countries can collaborate in energy, mining, and manufacturing sectors, combining Pakistan’s industrial base with Kazakhstan’s rich natural resources.

- Direct banking channels: Establishing financial linkages will simplify cross-border payments, reduce transaction costs, and encourage private sector trade.

- Simplified visa policies: Easier visa rules for business professionals and traders will accelerate people-to-people connectivity and strengthen business ties.

- Regional connectivity: Leveraging Gwadar Port, CPEC, and QTTA together as a complete connectivity solution can transform Pakistan into a gateway for Central Asian trade.

Policy Recommendations:

To unlock the full trade potential, both governments need to adopt pragmatic policies:

- Develop trade facilitation centers at key border crossings for smoother customs and logistics.

- Launch a Pakistan–Kazakhstan Business Council to institutionalize trade cooperation and resolve bottlenecks.

- Expand air connectivity through direct flights, reducing travel time for traders and investors.

- Maintain consistent trade diplomacy with the aim of achieving the ambitious $1 billion bilateral trade target.

Conclusion:

The Pakistan–Kazakhstan trade relationship stands at a decisive point—full of opportunities yet challenged by structural barriers. With strategic use of the QTTA transit trade routes, Gwadar Port, and CPEC connectivity, both nations can create a stronger Pakistan–Central Asia trade corridor. This partnership not only promises economic growth for Pakistan and Kazakhstan but also holds the potential to transform the entire region into a hub of prosperity, stability, and regional integration.